We’ve seen swings in the commodity markets in recent weeks. Emerson’s Alan Novak, leader of the alternative energy and metals & mining industry team, looks at global copper mining developments.

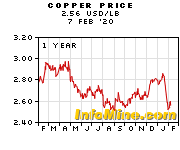

As highlighted in a recent Wall Street Journal article, Copper Recedes Near Production Cost, copper prices are currently sliding toward the estimated cost of production for the industry’s highest cost producers (estimated at $2.80/lb).

So what is driving the price slide?

A number of factors; several new greenfield projects have come on line and the world’s largest copper consumer, China, is experiencing slower than anticipated growth. Even with these events, underlying growth in demand is expected to remain steady or increase over the next few years.

An unlikely support for the market came from nature, in the form of a slide at Rio Tinto’s Bingham Canyon mine in Utah. The event, which occurred on April 10 and was discussed in this article in the Sydney Morning Herald, Rio Tinto earnings face hit after mine slide, will reduce copper production by approximately 100,000 tonnes in 2013 (which is roughly 10% of US production or 0.6% of global production).

Photo of Rio slide:

So where does copper go from here? Given that there is presently no better metal for infrastructure (electricity and telecommunications) and that demand from the developing world is expected to continually increase over the coming years, the future looks bright. Have we yet hit a bottom? Only time will tell.