The availability of natural gas from shale formations is impacting many sectors of the process manufacturing marketplace including alternative energy, oil & gas, electrical power generation, and petrochemicals to name a few. It is even impacting the availability of jobs as highlighted in yesterday’s post. Emerson’s Alan Novak, leader of the alternative energy industry team, highlights some of the fundamental changes occurring in the global energy market.

In previous posts, we have reviewed some of the impacts unconventional (shale) gas is having on the energy market. There are also frequent articles published regarding recovery technologies, regional market dynamics and other aspects of this emerging energy source. What has been missing so far is a comprehensive review of the global picture.

For anyone interested in a very good overview of the global natural gas market I would highly recommend reading the Special Report: Natural Gas insert contained in the July 14 issue of The Economist.

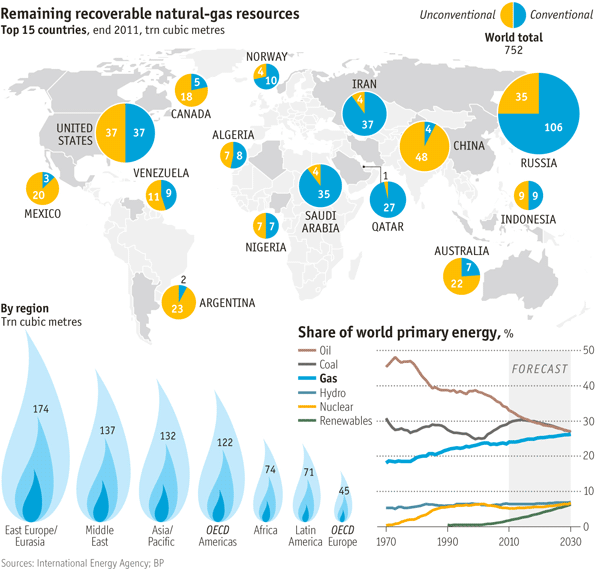

The report does an excellent job of summarizing the potential global supply of unconventional gas resources and the numbers are staggering. Estimates of available natural gas have climbed from 40-50 years-worth to more than 200 years-worth within the last five years (thanks to shale gas).

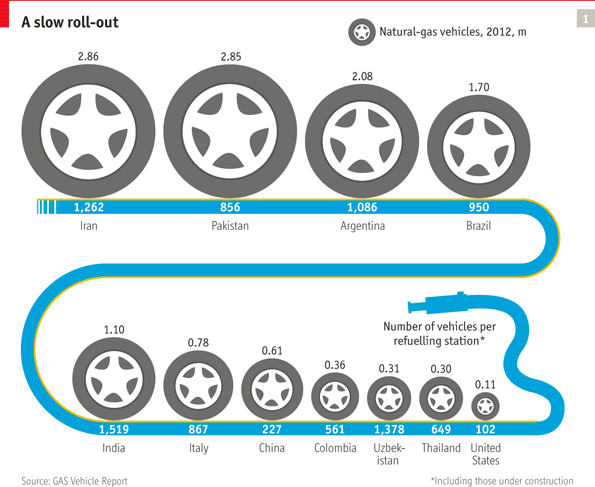

The impact of this increased supply on a number of sectors—power production, chemical manufacturing and potentially transportation, is also discussed. Most of the impact today is being felt in the US since it is the first to deploy hydraulic fracturing production technology on a wide scale. Other countries have similar unconventional reserves (China and Russia’s are comparable) but have not yet moved to develop them.Use of Compressed Natural Gas as a motor fuel as noted by this graphic in an Economist article, Gas works:

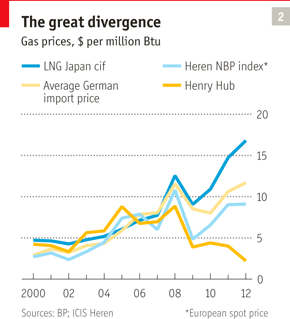

The report also provides a good impartial overview of the hydraulic fracturing process and discusses some of the resistance to the process in Europe.One of the most interesting sections deals with the divergence of US natural gas prices and the global Liquefied Natural Gas (LNG) market. While US natural gas has declined to historic lows ($2.00 mBtu at one point) LNG prices have continued to rise, largely due to LNG contract prices being linked to the price of oil (rather than a natural gas market price).

While this opens up opportunities for US exporters the margin is less than it may seem. When costs for liquefaction, transportation and regasification are added in US gas at $2.00 mBtu becomes US LNG at $6.00 – $9.00 mBtu landed in Asia. Still attractive given current market prices in Asia, but the added demand from export may well cause the underlying US price to increase. There is also significant discussion occurring over whether it will be politically possible to export a plentiful US energy resource.This report highlights how an energy source, unconventional gas, which was largely unknown less than a decade ago has fundamentally changed the global energy landscape. It also raises the question of what other resources are yet to be discovered.