Raising capital for biofuel producers is becoming more difficult as shared by Emerson’s Douglas Morris of the alternative energy team in today’s guest post.

Over the past couple of years, there have been a number of companies that have issued IPOs [initial public offerings] in the alternative fuels space. Issuing stock has been an important milestone for these companies as the process raises the much-needed capital required to construct demonstration and commercial scale plants.

Last week, Enerkem, a Canadian company that makes ethanol from Municipal Solid Waste (MSW), pulled their IPO as interest in the stock offering fell short of expectations. By all accounts, Enerkem looks like a solid company with long-term feedstock and off-take agreements, coupled with backing from the Canadian and US governments.

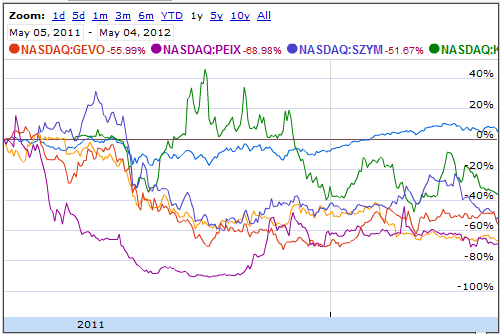

Okay, so why was there not more interest in their IPO? It may be due to the fact that stock issues from other alternative fuel companies have struggled. Below is the performance over the last year of a snapshot of companies in the industry, all of which have a combination of solid business models and well-regarded company leadership. Changing energy policies, changing commodity prices, and difficultly in scaling up technology have all contributed to a difficult environment.

Right now, Enerkem looks to forge ahead with other methods for financing their projects. Meanwhile, other IPOs are waiting in the wings, including Elevance and Mascoma. It will be interesting to see how advanced biofuels stocks perform in the dynamic energy sector, particularly as support for alternative fuels using loan guarantees and subsidies are cut as governments look to balance their own ledgers.