Commodities prices such as copper continue to fluctuate based on the economic softness in certain regions of the world. Emerson’s Juan Carlos Bravo of the metals and mining industry team, shares his perspectives from the recent CRU World Copper Conference.

Last April, I attended CRU’s 12th World Copper Conference in Santiago, Chile [CRU was originally named Commodities Research Unit]. This copper conference brings together analysts, investors and main copper producers in the world. Many leading mining companies including Codelco, Antofagasta Minerals, Rio Tinto, Freeport McMoran and more, delivered presentations.

One of the main topics was the outlook for copper prices. After several presentations from analysts and mining companies, my sense was that despite of the recent declines in the copper price, in the medium-to-long term, the price would increase. The reason for this is because the presenters anticipate that China’s demand for copper will be substantial regardless of its recent slowdown in economic growth. In addition, there is currently not enough copper in the world to meet the future demand of electronics and electrification or rural areas in the developing economies.

They anticipate more Greenfield projects globally in order to meet future demand and bridge the supply gap. This holds true despite the possibility of using aluminum as a substitute of copper in some applications.

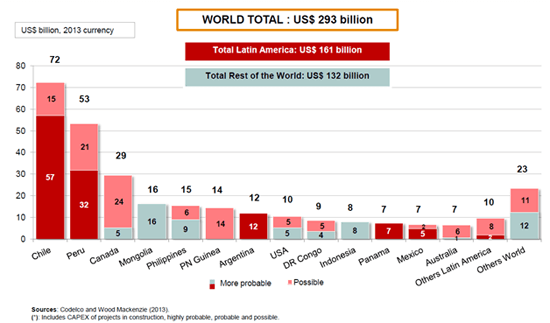

Projected investment in copper (period 2013-2021):

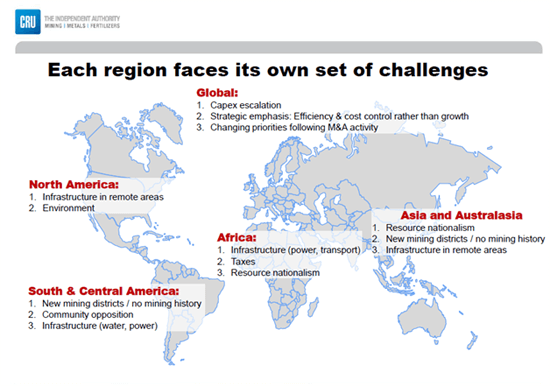

But this bright future doesn’t come without challenges. Chile, for example, still has large reserves of copper and continues to see large capital investments in mining. But mining in Chile is threatened by the lack of power and water. Mining operations need huge amounts of affordable power and water, so investments in power plants and desalination plants might be bigger than the mining Greenfield projects in the Southern Cone in the next four years in order to make the mining economics work.Also, a shortage of experts and labor with the right skill sets in mining is a global issue. This makes it more difficult to operate the mines and impacts the labor costs since everyone is trying to attract or retain experienced employees.

Finally, mining and environmental regulations are getting stricter around the globe. This is causing the cancelation or delay of new projects due the complexity and cost of meeting these new standards.

In terms of rising stars in mining, Peru and Africa are it. Peru is different from Chile in that the country has energy, water and more available workers than its southern neighbor does. If they are able to resolve the issues with local communities, they could surpass Chile in mining investments. Also, some analysts have mentioned the African continent as the next big opportunity for mining. With plenty of water, power, low-cost labor and pristine mines with high ore grades, it can become the next hot spot for mining. But some experts remain skeptical about Africa due its political climate and threats of nationalization of some mines by some governments in the region. If the Africa countries can overcome these political problems, the continent can attract huge investments to the region in the near future.I think this was a great conference and was glad to hear that copper will continue doing well in the near future with solid demand of the ore. It also was great to hear that despite so many challenges, a lot of copper producers see Innovation as a way of controlling cost and overcome the challenges they face.

Innovation and copper, go hand to hand in to the future. Not just to produce all the future gadgets that promise to make our life easier and to help us to be connected, but also to help in keeping mining sustainable and viable moving forward.