Emerson’s Juan Carlos Bravo of the metals and mining industry team looks at what the Chinese year of the snake may have in store for the mining industry.

According to Chinese Zodiac, on February 10 we are starting a new lunar year—the year of the snake. But, this is a year that symbolized fear and political disturbances, so let’s reflect on what this may bring to mining.

No doubt that this year of the snake starts with some bad omens for the industry: a slower Chinese economy, low demand for commodities resulting in low prices, higher taxes, resignation of CEOs of some of the mayor mining companies, strikes in South Africa, threats of nationalization, big write downs affecting stock prices, and more. With all of these, we might think that astrology predictions are correct and that this year will not be a good year for mining.

But setting superstition aside, let’s remember that mining always has been cyclical, and despite the bad news, the long-term projections remain strong for the industry. As stated in the 2013 Annual Survey of Mining Investment from the Engineering & Mining Journal, the Raw Material Group (RMG) remains optimistic for the long-term outlook of the mining sector.

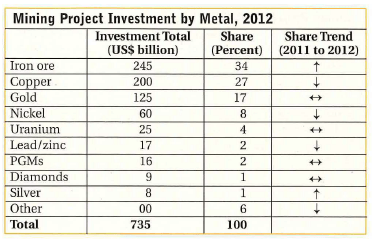

The main reasons are the population growth, as well as the urbanization and general economic development in the emerging economies that are still positive and provide a strong base for continued growth in metal demand. Hence, the need remains for increased mine production and for new investment projects. This is demonstrated by the still large amounts of announced investments worldwide, lead by iron ore, gold and copper.

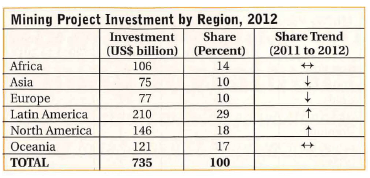

We can see this investment trend has increased in Latin America and Canada compared with last year’s survey:

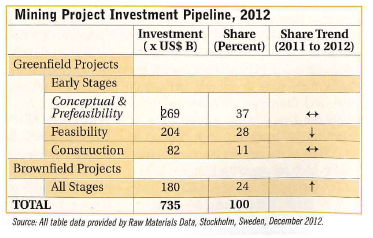

In addition, brownfield investments went up and remain strong despite the fact that many brownfield projects go unreported since they are executed internally:

In my opinion this are clear indication that the mining sector is slowing down but it will continue investing in its current mines in order to make them more efficient and more safe. That is why I expect we’ll see more investment in technologies that will help improve recovery rates and reduce downtime.I also think that Latin America will play an important role in recovery of the industry, not just as a producer with its low production costs and relative stable political environment, but also as a consumer, since some of the fastest growing emerging markets are located here—such as Brazil and Peru. A growing middle class is creating demand for more goods and services.

I normally dismiss horoscopes, but this time I might take stock in what I read in a Chinese horoscope, “According to astrological tables, this year’s snake is less venomous, is more humble and patient. This year will remain challenging as a whole but we see good opportunities for economic growth.” I couldn’t have said it better in what the year of the snake will bring to mining.