Recently, we’ve seen many changes in the gas processing marketplace, moving us quickly from a time where we built all forms of infrastructure to a more thoughtful focus on efficiency, reliability, productivity, and reducing operational risks.

Our industry is, therefore, experiencing many operational challenges from producing vast natural gas resources in remote and hostile environments, to transporting gas to processing centers, end-users, and distribution centers.

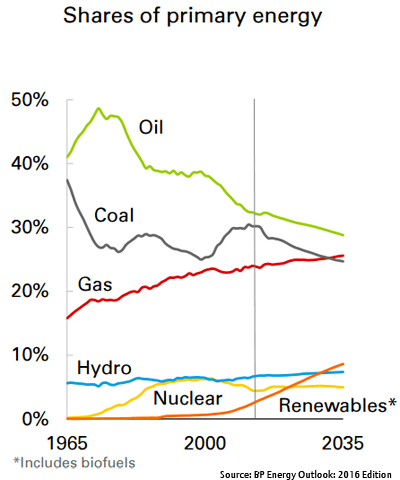

While natural gas is now considered the most environmentally friendly fossil fuel, the recent collapse in oil prices and higher uncertainties about a quick recovery are slowing marketplace growth. In 2015, natural gas accounted for about 24 percent of all primary global energy consumption. While there is still plenty of room for growth, project developers must be clever in forging new natural gas markets that drive down costs and maintain market momentum.

While natural gas is now considered the most environmentally friendly fossil fuel, the recent collapse in oil prices and higher uncertainties about a quick recovery are slowing marketplace growth. In 2015, natural gas accounted for about 24 percent of all primary global energy consumption. While there is still plenty of room for growth, project developers must be clever in forging new natural gas markets that drive down costs and maintain market momentum.

There’s been a massive build-out for oil and gas production in the US relative to shale developments, resulting in unprecedented growth in natural gas with more than 100 new processing facilities across North America in the last five years. Many gas processors are finding it difficult to transition from a project driven, “build it fast or build it to last” investment-based culture to one focused on increasing operational efficiency, reliability, and reducing operational risk.

While much of North America’s natural gas and liquids production will be absorbed by the ethanol, methanol, and chemical industries by 2020, Liquefied Natural Gas (LNG) developers are creating an oversupply, which will increase global competition for Eastern European and Asian markets.

Many unforeseen industry challenges will arise from an export capacity ramp up in both Australia and the US, resulting in a dogfight for market share leading to low prices, squeezed geographic differentials, and overbuilt export capacity.

From the export standpoint, most of the current capacity has been constructed based upon long-term and medium-term take or pay commitments that ensure facility owners will be able to service their debt regardless if the consignee takes possession of the product. Most consignees are either end-users who produce power and agricultural fertilizer components or aggregators who contract the LNG to sell on the open market.

While aggregators serve important roles in developing the global spot trade market, many of their system volume obligations don’t have destination commitments, so they’ll endure competitive prices and geographic differentials through 2020. To alleviate low prices, squeeze geographic differentials, and absorb new export capacity, they may serve as the catalyst to a global import market expansion.

Traditional importers are saturated with existing contracts and many emerging economies are attracted to the low price of LNG and its suitability for several energy applications. Regasification facilities and floating storage and regasification unit (FSRU) developers are confident that new markets can develop quickly by implementing floating regasification assets where geopolitical change and limited financing have traditionally affected import opportunities.

Traditional importers are saturated with existing contracts and many emerging economies are attracted to the low price of LNG and its suitability for several energy applications. Regasification facilities and floating storage and regasification unit (FSRU) developers are confident that new markets can develop quickly by implementing floating regasification assets where geopolitical change and limited financing have traditionally affected import opportunities.

FSRU developers see about 30 to 35 prospective projects globally and are now an accepted part of the LNG value chain. Many are now providing a complete floating infrastructure service, not just regasification.

From a business perspective, understanding how midstream players expect to enable new business expansions is the key to stimulating new build-out in the regasification market over the next five years.

Industry experts understand that financing new projects requires creative thinking and automation technology that holds a facility’s project development costs, schedules, and startup quality to predictable levels. This will certainty guarantee that developers with a “design one, build many” approach gain a strong foothold and create a high probability for success with emerging economies around the globe.

From Jim: You can connect and interact with other midstream oil & gas experts in the Oil & Gas group in the Emerson Exchange 365 community.