Emerson’s Juan Carlos Bravo of the metals and mining industry team describes the changes occurring in Latin America through Chinese investments.

In today’s world, we are used to seeing China as the big consumer of global raw materials, with the demand helping to set the prices in commodities such as iron ore, gold, copper, nickel and other raw materials needed for continued industrialization. But few of us are used to seeing China as a provider of big mining equipment or a big capital investor in mining projects.

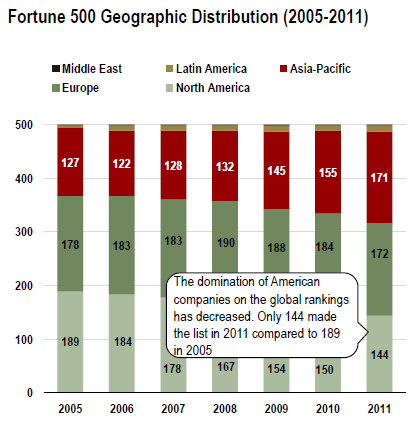

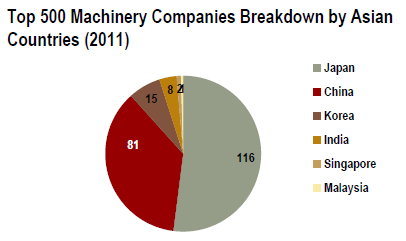

While attending EXPOMIN in Santiago, Chile, I saw how large the China presence was—95 different equipment suppliers and a half-day session to promote Chinese investments in mining in Latin America. Here I learned that Asian companies continue to lead the top 500 machinery rankings, and an increasing number of Chinese manufacturers are emerging as the global leaders in their respective segments.

With the allure of lowering procurement costs, I learned that large companies like CODELCO are procuring most of it tiers and refractory brick from Chinese suppliers and looking to expand it to other products made in that country. In addition, Chinese companies are leveraging their relationships with their suppliers in order to exchange copper for equipment.China is now moving beyond just supplying equipment to establishing mine ownership stakes. I learned that Chinese capital is behind the investment in two mines in Ecuador, two mines in Peru, and have planned a lot more investments in key sectors like power and manufacturing.

I believe we will see more Chinese companies entering the mining equipment market space since they have proven to be successful in developing technology for several other industries. By offering cost benefits when procuring equipment when building a plant, helps the project’s return on investment. But I also believe Chinese companies will face similar challenges when entering the mining industry—energy prices, scarce water, environmental restrictions, relationship with local communities, and lack of local, qualified workers.There is no doubt that a new competitive landscape is unfolding and it is apparent that China has an aggressive investment plan for the Latin-American and African markets. The industry will continue to adjust to the changes introduced by these plans as they continue to impact suppliers and mining companies.