Author: Alan Novak

Author: Alan Novak

As noted in a recent Financial Post article, the world’s largest mining companies have fallen on hard times. Since 2011, global mining stocks have lost $1.4 trillion in value; more than the value of Apple, Exxon Mobil and Google combined. A few charts of the underlying commodities and related company stocks show just how bad it has been.

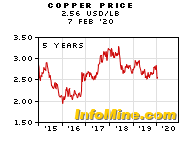

Global copper price:

Source: InfoMine – 5 Year Copper Prices and Price Charts

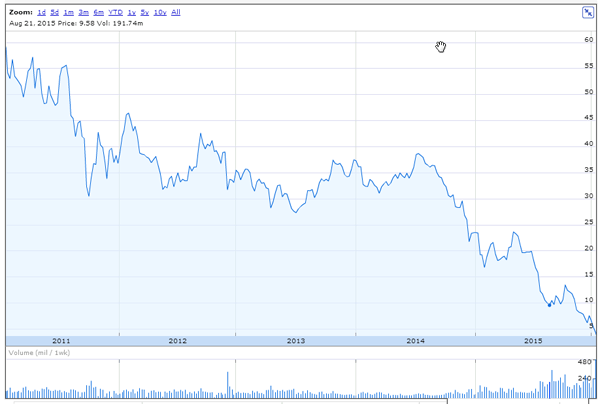

Freeport McMoRan stock:

Source: Google Finance

Iron Ore Price:

Source: InfoMine – 5 Year Iron Ore Fines Prices and Price Charts

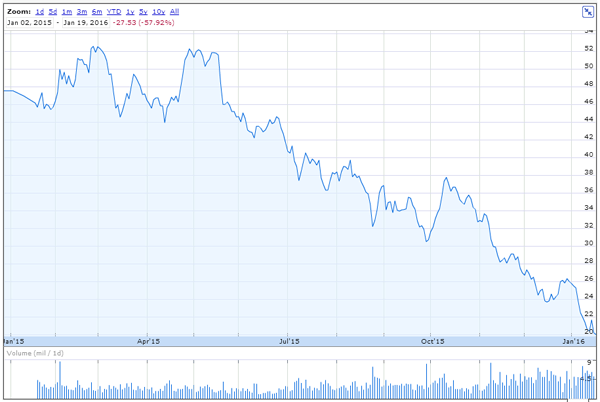

BHP Billiton stock:

Source: Google Finance

So what caused the decline? A combination of factors. Slowing growth and softening demand from the world’s largest metals consumer, China, combined with an abundance of supply coming on line from “supermine” projects that were initiated during the commodities boom. Since 2007 mining companies have spent over $100 billion per year on projects such as Rio Tinto’s Oyu Tolgoi copper and gold mine in Mongolia, Freeport’s Cerro Verde copper mine in Peru and Anglo American’s Minas Rio iron ore mine in Brazil which bring millions of tons of supply into an already weak market. Cerro Verde alone is expected to produce up to 1 billion pounds of copper per year (about 3% of the global total).

From a recent Wall Street Journal article, Supermines add to Supply Glut of Metals [subscription required]:

Those giant mines are now giving the industry an extra-bad hangover during the bust. The big mines cost so much to build and extract minerals so efficiently that mothballing them is unthinkable—running them generates cash to pay down debts, and huge mines are expensive to simply maintain while idle. But as a result, their scale means they are helping miners dig themselves even deeper into the price trough by adding to a glut.

How long will it take the mining industry to work through this period of oversupply? Only time will tell.