In a Hydrocarbon Engineering article, Emerson’s Jake Davies looks at corrosion monitoring from a cost/benefit standpoint.

Imagine this situation, which probably won’t require too much effort to visualize. You have an eight-year-old car, and looking at your personal budget, you ask, “Shall I keep this car and continue doing the increasing amount of service work, or buy a new one and spend less time at the garage?” The former represents operational expenses (OPEX), whereas the latter represents capital expenses (CAPEX).

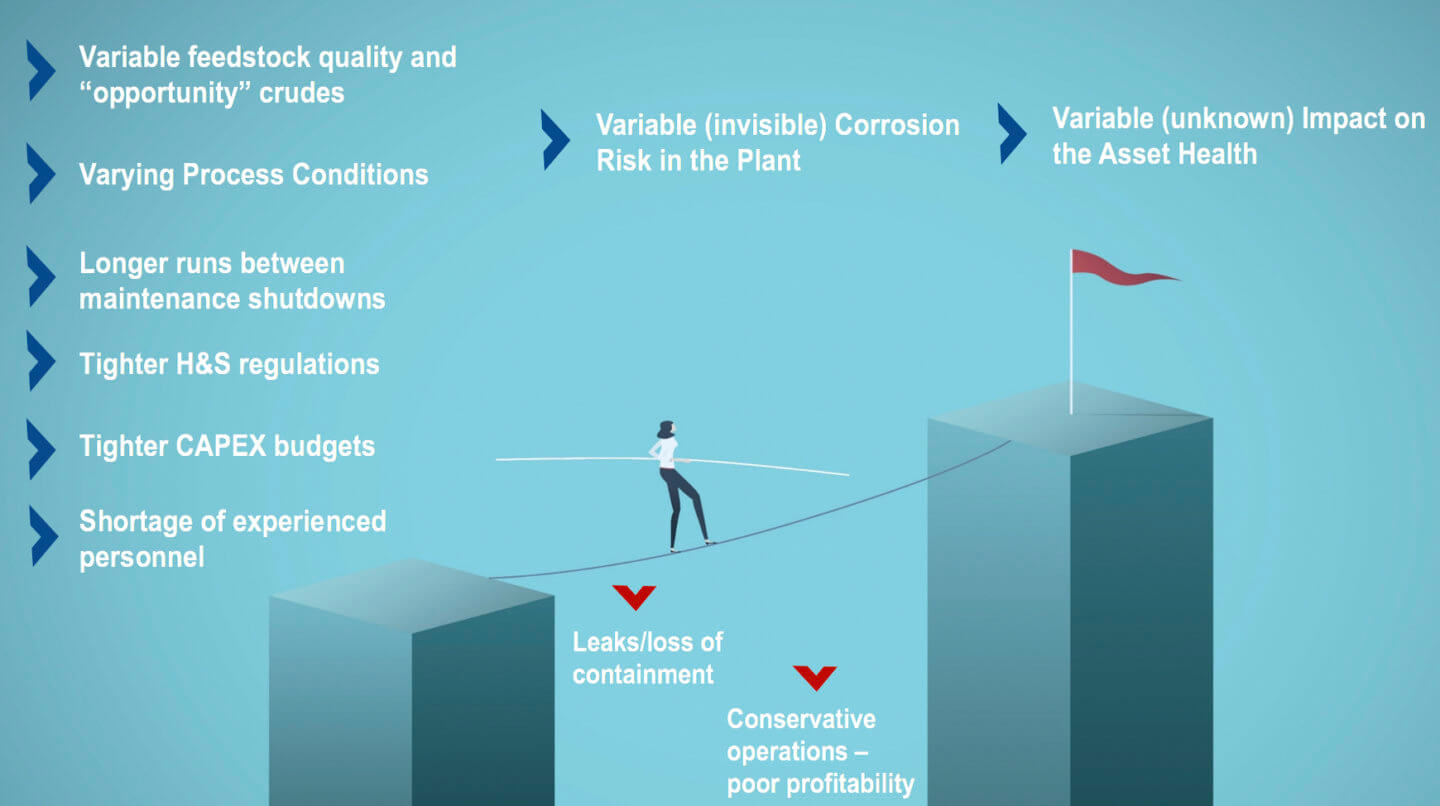

It’s not a perfect analogy, but refineries have a similar choice when it comes to corrosion. Crude oil is corrosive. It may be minimally so, or can be truly aggressive depending on the source. It eats away pipes, valves, and vessels from the inside out. So how should refinery managers deal with it? That question is the main topic of my article in the October issue of Hydrocarbon Engineering. Should they be looking for CAPEX or OPEX solutions?

CAPEX:

Invest in plant or unit upgrades, replacing the most critical piping and equipment with higher-grade alloys and heavier schedules able to withstand corrosive feedstocks and process conditions over a long service life. This is obviously an expensive solution and takes time to implement. Planners will have to decide how far to carry the upgrade but, once completely done, it solves the problem without creating ongoing costs, assuming the corrosiveness of feedstocks does not increase even more in the future.

OPEX:

Attempt to reduce the metal loss caused by corrosive process fluids by adding corrosion inhibitor additives. This can be very effective but presents its own challenges. First, the inhibitor must be matched to the corrosive agent(s) in the crude and the concentration. An ineffective combination does not solve anything and wastes the additive, so the effectiveness must be optimised and reevaluated whenever there is a feedstock source change or other process adjustment. Under the best circumstances, this can be a viable solution, but it carries an ongoing cost.

In the real world, any solution will undoubtedly involve a mix of those two, but it is difficult to implement a solution of any kind without knowing what the equipment condition is right now, and where it’s headed. There’s no sense in discussing mitigation strategies if pipes have lost so much metal that they’re about to burst. Ultrasonic wall thickness monitors can fill that knowledge gap, providing plant personnel with the information they need to make optimal decisions.

This historical information then informs determination of where the unit might be headed: is it reasonable to think present trends will continue, or can the process be adjusted to reduce the degree of metal loss? When should required piping replacement be anticipated? Fortunately, effective monitoring systems can deliver the data automatically to those who need it. Sophisticated visualisation and analytical tools reduce the time needed for analysis and interpretation.

Monitoring is much easier now with metal thickness sensors, including Emerson’s Rosemount Wireless Permasense WT210 Corrosion and Erosion Monitoring System. These sensors provide visibility of corrosion and erosion trends in real-time using unique ultrasonic sensors to continuously measure pipe thickness. They are non-intrusive and battery-powered, allowing for quick and straightforward installation. The reliable, accurate wall thickness data is delivered via a WirelessHART® network to the accompanying software, helping you make better decisions regarding pipe maintenance and replacement.

What’s the condition of your pipes? Good for years to come, or is a burst imminent? Visit the Rosemount Wireless Corrosion & Erosion Monitoring pages at Emerson.com for more on technologies and solutions for asset condition monitoring. You can also connect and interact with other engineers in the Oil & Gas and Chemical Groups at the Emerson Exchange 365 community.