Emerson’s Alan Novak, leader of the Alternative Energy industry team, explores how the rapid increase in shale production has impacted coal conversion, liquefied natural gas (LNG), and Substitute Natural Gas (SNG) in today’s guest post.

A few weeks ago, we looked at the impact of plentiful US shale gas on US manufacturing. It also has a potential impact on two other global markets: Substitute Natural Gas (discussed previously here) and LNG.

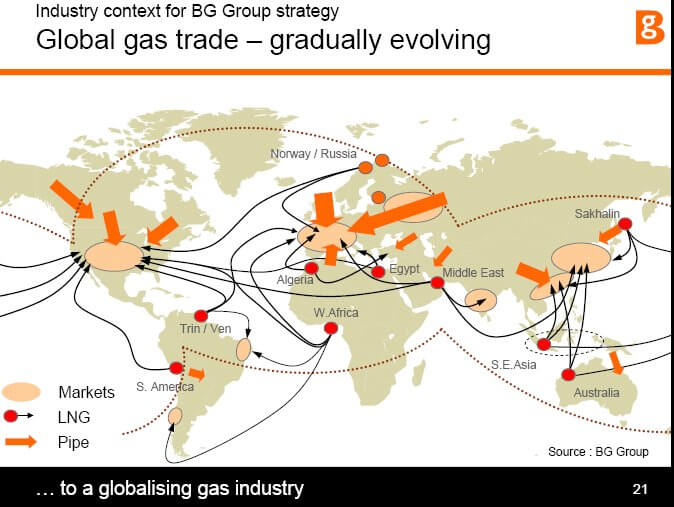

First a definition: LNG is conventional natural gas chilled to a liquid state. This increases its energy density and allows it to be stored and shipped—via special tankers and through special liquefaction/re-gasification terminals.

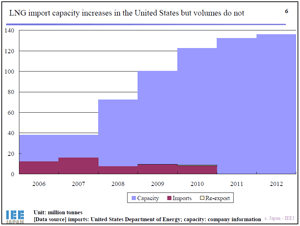

Prior to the discovery and development of US Shale Gas deposits (as recently as 2006), it was assumed that the US would be a large consumer of global LNG supplies to meet its energy needs.

This changed dramatically in the last few years.

Re-gasification terminals were built in the US in the late 2000’s to address anticipated demand (which never materialized). Some of these terminals may be converted to liquefaction terminals to allow the export, rather than import, of natural gas.

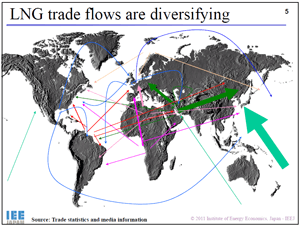

The disappearance of US LNG demand has allowed supplies to be re-directed to Asia, which should help mitigate recent price spikes. LNG for spot delivery in Japan and South Korea was up 29% and 26% respectively in 2011.The Impact on Substitute Natural Gas development

As mentioned previously, the primary driver for SNG development is a high LNG-to-coal price differential, which offsets the added processing cost of converting coal to natural gas. As LNG becomes more plentiful in Asia, this differential should begin to narrow. The question will be at what point are these projects no longer viable.

The largest variable in the entire equation is how the US handles hydraulic fracturing regulation. Changes in US policy will quickly cascade through the global energy value chain.

This interaction highlights that at some price all forms of non-electrical energy (coal, oil, natural gas, and biomass) become economically interchangeable.