In today’s guest post, Emerson’s Alan Novak, director of the alternative energy industry team, explores the role of government policy in renewable energy’s boom and bust cycles.

As Doug Morris mentioned last week, the renewable fuels market is facing uncertainty due to a lack of clarity in tax, funding and energy policy.

A similar situation exists in the renewable power market.

Various credits and subsidies have been in place over the years to encourage development of renewable power: the Investment Tax Credit (ITC), the Production Tax Credit (PTC), and lead-in tariffs for electricity produced from renewable sources (lead-in tariffs are primarily used in the European Union).

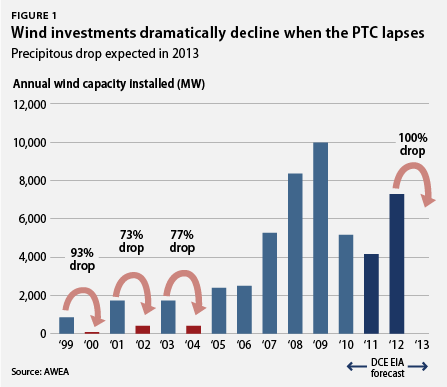

Over the years, these development incentives have faced varying degrees of support in the U.S. Congress. When they fall out of favor, the impact is dramatic:

Since the current $0.02/kilowatt-hour, Production Tax Credit for wind power expires at the end of 2012 (and there is currently no indication it will be extended), producers are rushing to get their projects on-line by the end of the year. While this will lead to a spike in new wind generation put into service in 2012, the uncertainty will likely lead to a crash of the wind market in 2013 (as has happened before).But it is not just in the US where these credits are inducing uncertainty.

Germany has a large share of the world’s installed photovoltaic (PV) solar power capacity (almost 50%) even though they would not be considered a “sunny” climate:

This has largely been due to generous “feed-in tariffs” made available by the German government, which provide a premium to suppliers of renewable power. Solar has boomed due to the tariffs, which were recently reduced to $0.2443 per kilowatt-hour. By comparison, the average US price for electricity is only $0.12 per kilowatt-hour.A recent article in the CS Monitor highlighted that it is costing the average German house $171 per year to support the subsidies, and a backlash is growing to sharply curtail the amount of the tariff. Germany currently plans to reduce the tariff by 9% per year.

Private investors are reluctant to step into markets where this degree of uncertainty exists. As various credits and tariffs expire, these industries will need to demonstrate they can be price competitive on a stand-alone basis to attract further capital.

Will wind and solar be able to compete on their own (subsidy-free)? Only time will tell.