In our mining category, we’ve highlighted some of the trends occurring globally. Emerson’s Alan Novak, leader of the mining and power industry teams, recaps some of the latest thinking.

Consulting firm Deloitte recently published a report “Tracking the trends 2013” detailing what they believe are the top trends in the Mining Industry in 2013.

Their analysis certainly indicates why mining is, and will continue to be, a very challenging industry. According to Deloitte the Top 10 trends in mining in 2013 are:

1. Pressure on Profitability

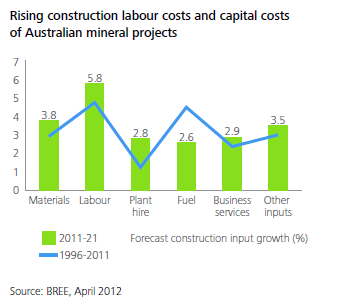

Mining companies are being squeezed by both escalating costs; energy and water, labor rates, governmental royalties and environmental compliance, while at the same time facing soft commodity prices.

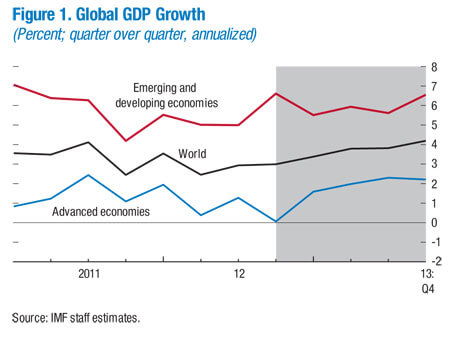

2. Uncertain Global DemandThe current slow-growth environment in the west, combined with a cooling of the economy in China (a relative term since 8% growth is still anticipated) is resulting in an uncertain environment for future capital projects. In Australia alone over $246B of capital projects have been put on hold due to concern over uncertain future profitability.

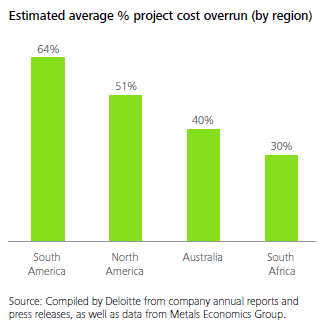

3. Capital Project Cost UncertaintyIn addition to the underlying commodity price uncertainty, recent greenfield capital projects have experienced significant cost overruns leading to further uncertainty in a mine’s ultimate profitability.

What impact this has on the universe of planned projects remains to be seen.

4. Accelerating Merger and Acquisition ActivityWhile the mega mergers appear to be slowing, Deloitte expects M&A activity among mid-tier mining firms to increase driven largely by money from Asia.

5. Increasing Resource Nationalism

From Guatemala to Mongolia, governments are exploring various ways to recover more revenue from the development of natural resources. Whether through direct legislation, windfall profit taxes or mineral resources rent taxes these increased financial burdens can further affect the profitability of a mine (sometimes retroactively).

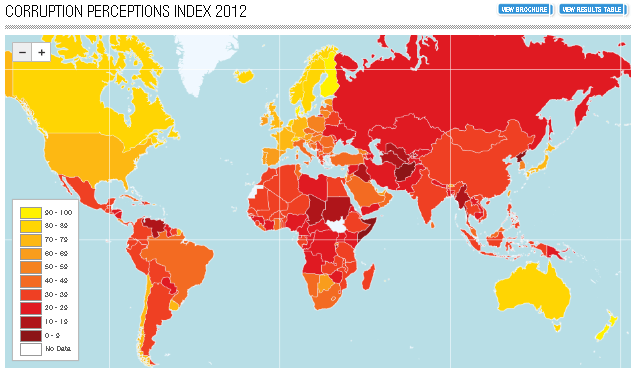

6. Increasing Pressure to Combat Corruption

Many mining reserves are located in countries with a fairly low “Corruption Perception Index” as defined by Transparency International. Mining companies are under increasing pressure to pursue development in these regions while ensuring compliance with global ethics standards.

7. Greater Focus on Corporate Social ResponsibilityCorporate Social Responsibility (CSR) is increasing in importance and is becoming a significant factor in new mine evaluation. Several recent projects have been suspended due to local opposition (Newmont’s Minas Conga project is an example) and gaining local, and national, support will become even more important in the future.

8. Industry Skills Shortage

Mines are typically located in remote locations with a limited skilled labor pool (or sometimes no labor pool at all). Mining companies will be faced with an increasing shortage of available talent and need to put training, or technology, in place to enable them to operate safely and efficiently with the resources available. The shortage is acute, with the Mining Association of Canada projecting a shortfall of 60,000-90,000 skilled workers by 2017.

9. Greater Focus on Developing a Safety Culture

Mining is a dangerous industry and while safety has improved dramatically, it remains the top concern among companies.

10. Greater Leveraging of Information Technology to Address Industry Challenges

Information Technology can take the form of process automation, remote monitoring, data analytics, or wireless technologies, and can help mining companies mitigate some of the issues highlighted above. Miners have been willing to embrace these technologies and will need to leverage them further as they move from a reactive to proactive operational model.