Douglas Morris

Mining and Power Industries Sr. Manager

The 33rd annual CERAWeek Conference, led by Daniel Yergin, was held this week in Houston, Texas USA. This year’s event very much echoed the theme from the last couple of conferences and focused on unconventional oil and gas.

The effects of these unconventional sources have global ramifications from both an energy and geopolitical standpoint. Abundant gas, in particular, is having the most dramatic impact. Because of the cost advantages it affords, global manufacturers are pouring capital into North America to monetize cheaper gas resources. Chemical manufacturers and other energy intensive businesses are finding this particularly attractive.

Although several applications for liquefied natural gas (LNG) export have been approved, there are many more awaiting consideration. The general opinion seems to be that the United States needs to strike a good regulatory balance of long-term energy security coupled with a sensible export framework. 2014 will likely be a pivotal year in shaping the domestic LNG market.

From a power perspective, the wealth of gas continues to reshape generation portfolios in North America. It has helped utilities provide affordable power and has reduced their carbon emissions. Risks of relying on gas too much surfaced this past winter. The polar vortex reminded utilities that the best approach to a long-term, stable power supply is to maintain a diversified fuel mix because gas supplies tightened and prices increased from the abnormal cold weather.

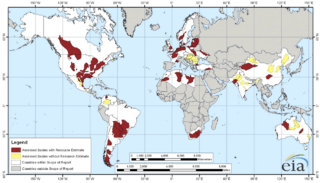

Other parts of the world are looking to harvest their unconventional resources too, but this may prove to be more difficult. China, for example, has some of the largest shale reserves in the world but its deposits are deeper and in a location where water is scarce. Not In My Backyard… without access to the royalties afforded by mineral rights, landowners are reluctant to allow oil and gas drilling and since many countries do not grant access to mineral rights like in the US, it will be more difficult to drill.On top of this, others lack the drilling expertise and open regulatory framework that makes unconventional resources easier to harvest in this country.

The last point is that across the spectrum, companies are exercising more capital discipline. Projects will still more forward, but more upfront planning will be required to avoid the cost overruns experienced in recent years. It will certainly be interesting to see how this story continues to unfold throughout the global energy value chain.